Most people chase freedom through external accumulation, yet their emotional wiring keeps them captive.

True independence originates inside: reprogramming scarcity patterns, integrating emotional charge, and training your nervous system to associate stability with calm rather than tension.

This in‑depth guide—part of the Self‑Coaching & Frameworks hub—weaves behavioral finance, self‑leadership, and depth psychology into a synchronized path toward enduring prosperity.

Before diving into tactics, remember: money mirrors consciousness. What you avoid internally multiplies externally—usually as debt or chaos.

What Is Financial Freedom?

Financial freedom isn’t about “never having to work again.” It’s about uninterrupted creative choice.

Whether you earn $60k or $2M, the question is: Does your financial structure support vitality or drain it?

Real freedom rests on four interacting pillars:

- Reliable income that exceeds expenses.

- Competent money management.

- Disciplined, values‑aligned habits.

- A balanced psychological relationship with wealth.

Each pillar has equal weight—a wobble in one destabilizes the rest.

For perspective, research from Kahneman & Deaton (2010) shows that income plateaus in emotional benefit around $75 k–$100 k (U.S.). Beyond that, well‑being correlates more with meaning than with money itself.

Freedom, then, is qualitative before quantitative.

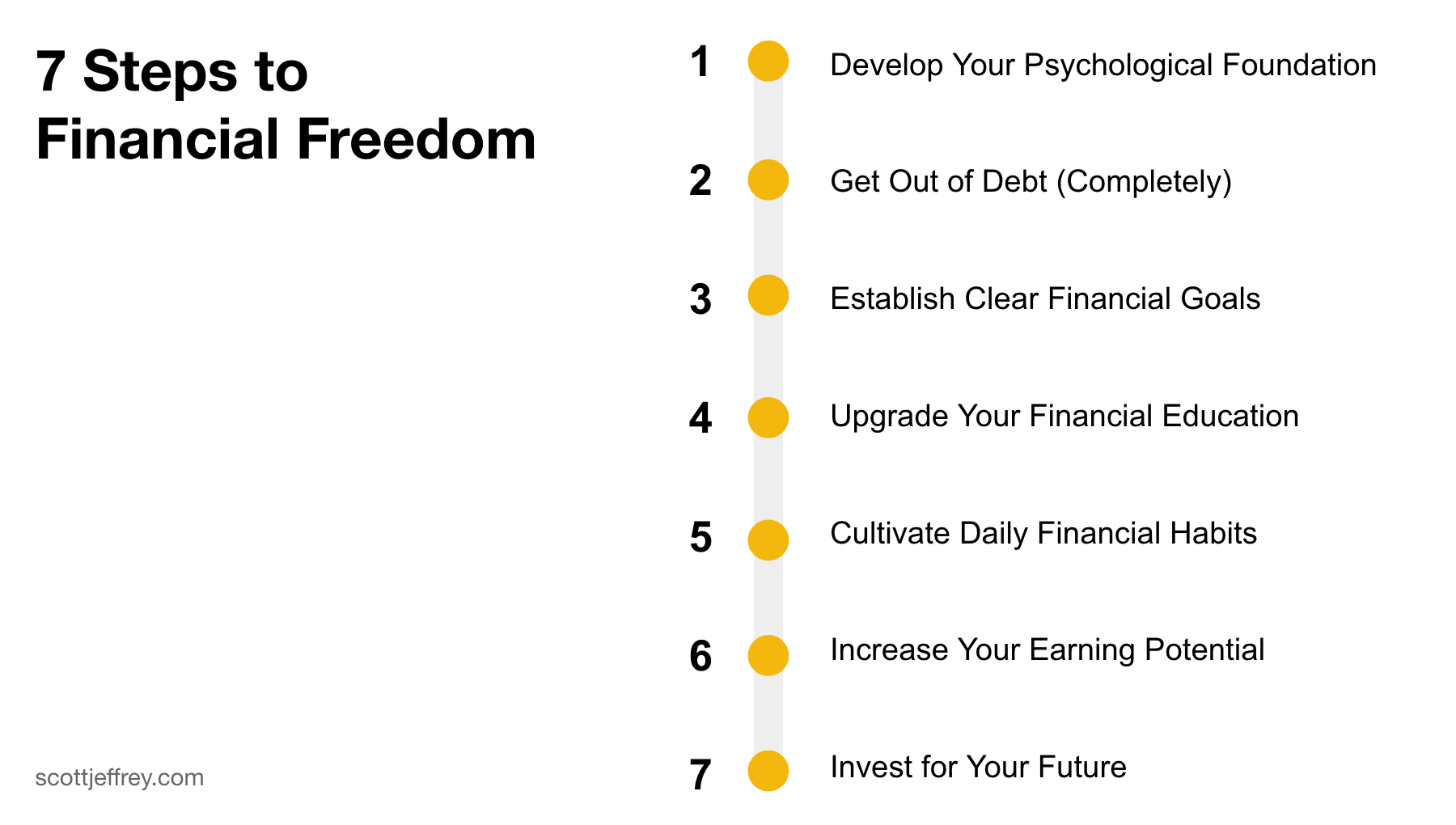

Step 1: Develop Your Psychological Foundation

Every financial plan collapses if your inner architecture opposes it.

Unconscious beliefs, inherited family scripts, and neurochemical habits will silently hijack the best spreadsheet.

Your task in this first phase is internal due diligence—auditing not your accounts but your conditioning.

A. Understand the Psychology of Scarcity

Scarcity is an attentional tunnel, described brilliantly by Mullainathan & Shafir in Scarcity (2013).

When attention fixates on “not enough,” cognitive bandwidth shrinks, and long‑range planning vanishes.

Combat this by dividing large financial goals into micro‑targets so your nervous system learns safety through progress.

For reflection tools, see the Wheel of Life Assessment to track where scarcity dominates your focus.

B. Recognize Conditioned Consumption

Modern economies are engineered for perpetual spending. Advertising hacks incentive circuits—especially dopamine release during anticipation of purchase.

We learn to self‑soothe by buying.

Awareness rewires this loop: observe urges without acting for 90 seconds; the neurochemical spike fades, revealing the emptiness driving it.

C. Observe Your Biochemistry

Spending thrills; saving rarely does.

The mismatch is biochemical, not moral.

Pair every saving action with a dopamine anchor—for example, visualize your Future Self thanking you.

D. Uncover Subconscious Programming

Money stories learned in childhood replay unconsciously until made explicit.

Ask:

- “What did my parents model about wealth and worth?”

- “Which emotions surface when I check my bank balance?”

Use journaling and body awareness to surface linked sensations—tight chest, shallow breath, jaw tension.

E. Integrate Guilt and Shame

Unprocessed guilt—whether for debt or success—is energy trapped in the body.

In the Repressed Emotions Guide, I explain how acceptance dissolves resistance.

Feel it, breathe it, own the pattern, then decide anew.

Doing this reconciling work before any financial overhaul prevents self‑sabotage later.

Step 2: Eliminate Debt and Release Guilt

Debt isn’t purely numerical; it’s stored emotion encoded in contracts.

Every statement balance whispers the phrase later, postponing integrity with your Future Self.

Treat this step not as punishment, but as energetic house‑cleaning before new creation can occur.

A. Face the Emotion Before the Spreadsheet

Start with awareness, not arithmetic. When fear or shame about debt surfaces, pause and center your body.

Use centering techniques—slow breathing, grounding, naming sensations.

Avoid suppressing panic; acknowledging it de‑charges its control.

Empirical data from the American Psychological Association shows unresolved money anxiety raises cortisol levels, impairing decision‑making up to 40 %. This is why calmness precedes calculation.

B. Construct Your Financial Dashboard

Once emotion stabilizes, gather data. Aggregate accounts with a tracking tool or manual ledger to visualize income, debt, and expenses.

Seeing the entire landscape converts chaos into clarity.

Purpose of the dashboard: provide feedback loops—an essential self‑coaching principle. You cannot master what you do not measure.

C. Perform a Reality Analysis

Define the timeline:

- How long until zero debt if you maintain current behavior?

- Then test three accelerated scenarios—12 months, 24 months, 36 months.

- This quantifies discipline instead of wishing for rescue.

Research from the National Bureau of Economic Research on “debt‑anchoring bias” shows that time‑bounded repayment plans dramatically boost follow‑through and self‑esteem.

D. Consolidate Intelligently

Credit markets compete for your interest payments.

Zero‑percent balance transfers can buy crucial time—if and only if spending stops.

Mark the expiration date of each promo period; automate reminders before it closes.

This is cognitive off‑loading: free memory for higher tasks.

E. Automate and Accelerate

Automation transforms willpower into infrastructure.

Set auto‑payments above minimums; dedicate each bonus or side‑hustle profit to principal reduction.

How to Change Your Habits explains how automation bypasses ego depletion.

Make progress visible—chart balances dropping; the brain loves pattern completion.

F. Acknowledge Progress and Release Shame

Most individuals carry secret guilt for financial mistakes.

Address it directly:

- Own your actions without self‑attack.

- Forgive your past self for ignorance.

- Replace blame with measurable commitment.

As detailed in How to Release Repressed Emotions, guilt metabolizes through honest ownership.

Debt freedom, therefore, is emotional detox plus fiscal strategy.

Step 3: Set Clear and Embodied Financial Goals

Without direction, the psyche drifts back to the comfort of chaos.

Goal‑setting turns awareness into architecture—anchoring emotional intention within measurable structure.

A. Clarify Your Future Self

Financial goals hold power only when tied to identity.

Who do you become as you gain stability?

Picture that version vividly: posture, environment, daily cadence.

The clearer the person, the fewer the compulsions.

See How to Craft a Personal Vision Statement to clarify your Future Self.

B. Define Your “Why”

Ask: What will money allow me to express that I cannot express now?

If the motive is status, entropy follows; if it’s freedom to contribute, momentum sustains.

Maslow’s hierarchy confirms that once basic needs are met, purpose—not possession—drives satisfaction.

C. Translate Vision into Timeframes

Short‑term goals (90 days – 12 months) train consistency circuits.

Long‑term goals (3–5 years) invite inspiration.

Link both through milestone bridging—smaller wins that simulate the end state.

Examples:

- Savings Goal: Add $2 k to an emergency fund by June.

- Spending Goal: Cut food delivery costs 10 % in 30 days.

- Earning Goal: Launch a side‑service producing $1 k monthly within 6 months.

Clarity is key.

D. Embody Your Metrics

Each number should correspond to a physical cue.

When you update your spreadsheet, notice breath depth, muscular tension, or relaxation.

Financial somatics converts abstract data into lived awareness—making accountability visceral.

E. Review and Re‑Center

Goals drift if not revisited.

Create a monthly reflection ritual using the Wheel of Life Assessment to balance financial aims with relationships, creativity, and well‑being.

Congruence sustains motivation longer than ambition alone.

Step 4: Upgrade Your Financial Education

A disciplined mind cannot operate on missing data.

Most adults were schooled in algebra—but never in compound interest, taxation, or credit mechanics.

This systemic omission ensures dependence on institutions rather than self‑mastery.

A. Acknowledge the Education Gap

Formal universities produce employees, not wealth architects.

A 2019 OECD study revealed that fewer than 34 % of adults could calculate basic investment returns or inflation impacts.

Without financial literacy, people substitute emotion for analysis—breeding chronic insecurity.

Understanding this gap removes shame; ignorance was designed into the curriculum.

B. Self‑Directed Learning as Freedom Mechanism

Begin a lifelong syllabus.

Blend timeless classics—Think and Grow Rich, Rich Dad Poor Dad, The Millionaire Next Door—with modern behavioral‑finance insights.

Track notes in a “money intelligence journal.”

Reflection converts reading into neural re‑patterning.

See 21 Self‑Development Skills to identify cognitive‑learning habits that accelerate comprehension and retention.

C. Study Behavioral Finance and Cognitive Bias

Financial loss rarely stems from insufficient math—it’s perception bias.

Learn how loss aversion, anchoring, and confirmation bias distort decision‑making.

Research from the Journal of Behavioral Decision Making (2022) confirms that investors with emotional‑regulation training outperform peers by 23 %.

Developing greater emotional awareness closes that skill gap faster than any spreadsheet app.

D. Mentors and Models

Expose yourself to mentors whose net worth aligns with your integrity, not your envy.

Interview peers on what they actually did rather than what they claim online.

Learning vicariously compresses decades into months—if filtered through discernment.

Education = experience + reflection.

E. Financial Education × Self‑Actualization

Money training is character development in disguise.

As competency grows, so does internal quiet.

Financial understanding reframes money from idol to instrument—frees bandwidth for creativity and contribution.

In Maslow’s terms, education transcends safety needs and nourishes esteem and mastery.

Step 5: Adopt Daily Habits That Build Wealth

Habits are the invisible hands shaping destiny.

Every repeated $10 decision or thought pattern compounds toward freedom or fatigue.

The difference between rich and poor often isn’t opportunity—it’s sequence repetition.

A. Habits as Neurological Programming

Willpower is finite; automation is infinite.

Roy Baumeister’s research on ego depletion showed that decision fatigue erodes self‑control throughout the day.

Translating insight into ritual converts costly decisions into effortless defaults.

List of Habits offers templates for turning awareness into automaticity.

B. Morning Rituals for Financial Clarity

Start days before the external noise.

Five‑minute review: gratitude → budget snapshot → affirmed intention (“I allocate with wisdom”).

Consistent rituals pre‑empt reactive spending.

See Morning Routine List to design a rhythm optimizing focus and self‑regulation.

C. Align Habits with Future Self

Each repeated act votes for an identity.

Before every expense, ask: Is this congruent with Future Me?

This micro‑pause integrates your long‑term vision directly into behavior.

Identity alignment trumps motivation.

D. Mindful Consumption vs. Dopamine Hijack

Instant rewards light neural fireworks that saving cannot match.

Counter by pairing saving with immediate emotional reinforcement—mantras, tracked victories, or visualization.

A Frontiers in Neuroscience (2021) study found gratitude journaling boosts dopaminergic tone, softening impulsivity.

Thus, emotional hygiene is fiscal hygiene.

E. Automate Good, Design Against Bad

Automation is mechanical compassion: it protects your future self from your tired self.

Auto‑transfer to savings the day income arrives; delay online purchases for 24 hours.

Structural design beats moral resolve every time.

F. Track Progress — Reinforce Success Chemically

Reward accountability.

Each financial check‑in releases serotonin—a stabilizing neurotransmitter.

Celebrate completion of micro‑goals with movement, breath, or journaling.

The ritual of acknowledgment closes feedback loops, confirming competence and creating flow.

Step 6: Increase Your Earning Potential

Wealth grows by subtraction and expansion.

Once spending stabilizes, new energy seeks creative output—productive abundance rather than anxious accumulation.

A. Shift from Employee to Value‑Creator

An employee trades finite time; a creator scales value.

Begin identifying skills that multiply with repetition—writing, coaching, coding, design, strategy.

Uncover where competence, curiosity, and contribution intersect. Your vocation hides inside that overlap.

Economic studies show that micro‑entrepreneurs who build around “skills synergy” enjoy 40 % higher lifetime income adaptability.

Adaptability, not capital, defines resilience.

B. Re‑Evaluate Self‑Worth Narratives

Many undercharge because childhood conditioning equated profit with moral decay.

As you self-assess, notice any guilt surface when requesting payment.

Price honors reciprocity; under‑pricing signals internal conflict, not virtue.

C. Design Ethical Side Hustles

Supplementary income accelerates freedom, but must align with your personal integrity.

Possible vectors include mentoring, design freelancing, tutoring, or productizing your knowledge.

Test options across four filters:

- Enjoyment

- Value to others

- Growth potential

- Ethical fit

Reject any that violate energetic sustainability—profit collapses without genuine enthusiasm.

D. Master Skill Stacking and Leverage

The modern economy rewards intersections, not silos.

For example, combining logic, communication skills, and psychology yields a coaching advantage. Similarly, design, technology, and marketing produce a product advantage.

Document complementary skill trios and dedicate 90 days to deepening each micro‑stack.

This intentional synthesis compounds faster than linear promotion ladders.

E. Reinvest in Yourself

Allocate a portion of every raise, contract, or client payment toward education, tools, or rest. Regeneration fuels production.

These Self‑Coaching Guides outline reflection templates for cyclical review. They can help you learn, apply the knowledge, rest and recover, and then continue scaling up.

Growth without recovery becomes depletion disguised as diligence.

Step 7: Invest for Long‑Term Security

Investment is not gambling; it’s stewardship.

Each dollar deployed becomes an employee for your Future Self.

Selective risk, governed by awareness, transforms capital into continuity.

A. Recognize the New Investment Landscape

Traditional “set‑and‑forget” portfolios ignore unprecedented systemic volatility.

Diversify across domains: assets you control, assets that produce, and assets that preserve.

Hard assets—gold, silver, real estate—anchor stability; equities and crypto offer growth.

Balance percentages according to risk tolerance and life stage.

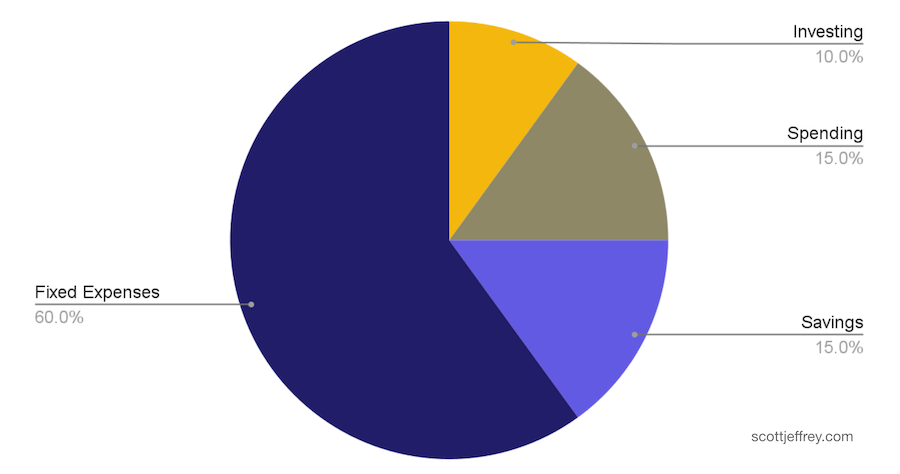

An Illustration of Asset Allocation

B. Define Asset Allocation

Typical starting template:

60 % fixed needs / 15 % savings / 15 % discretionary / 10 % investments

Automate the transfers monthly so decisions disappear.

The repetition—consistency without thinking—builds compounding confidence as much as compounding interest.

C. Diversify Intelligently

Use cross‑sector diversification: market sector, capitalization size, geography, dividend vs growth, tangible vs digital.

Academic consensus confirms that proper diversification lowers the variance ratio without reducing compound annual growth (see Goetzmann & Kumar, 2008).

When risk frightens you, ground yourself before transacting; emotionless decisions earn better than hurried ones.

D. Invest in Meaningful Assets

Beyond markets, invest in skills, relationships, and health.

Your body is the original appreciating asset.

Neglecting it collapses your total return.

Sleep, strength‑training, and meditation often outperform any index via mental clarity dividends.

E. Automate Rebalancing and Reflection

Quarterly reviews: audit not just numbers, but psychology—fear, greed, detachment.

If an asset evokes either extreme emotion, trim position size.

Cold logic preserves warm nights.

Financial Freedom and Self‑Actualization

According to Maslow, higher fulfillment arises once basic needs settle.

Money disorders—scarcity, shame, envy—bind psychic energy required for creative maturity.

Thus, achieving a threshold of autonomy is not greed; it’s foundational hygiene for personal evolution.

When wealth reflects inner alignment rather than compensation for insecurity, self‑actualization ignites naturally.

Freedom as Self‑Regulation Created in Practice

Financial freedom is neither sudden fortune nor relentless frugality. It’s the coordination of awareness, structure, and nervous‑system peace.

Every framework in this series—the dashboards, reflection prompts, automation rituals—exists for one reason: to transfer authority from external volatility to inner equilibrium.

The mature relationship with money resembles meditation:

- Sensation arises (market change, bill, windfall),

- Awareness notices,

- Choice follows.

Through that repeated noticing, chaos becomes rhythm.

When you integrate psychology with financial literacy, money ceases to define identity and becomes feedback.

Each balanced account, disciplined habit, or new investment is evidence of self‑trust embodied.

You’ve now built a loop that sustains itself:

- Insight

- Practice

- Measured Result

- Renewed Awareness.

Repeat it long enough, and financial freedom grows indistinguishable from inner freedom—the real dividend of self‑actualization.

Freedom isn’t purchased; it’s practiced.

Read Next

How to Use the Wheel of Life Assessment to Improve Your Level of Fulfillment

Sexual Energy Transmutation: A Beginner’s Guide to Inner Alchemy

How to Create a Personal Development Plan that Inspires Meaningful Results

21 Self‑Development Skills for Growth & Self‑Actualization

This guide is part of the Self‑Coaching & Frameworks Series.

Apply structured self‑development models that unite awareness and action. Learn how feedback loops, values, and reflective tools support personal mastery.

Scholarly References

- Baumeister R. & Tierney J. (2011). Willpower: Rediscovering the Greatest Human Strength.

- Mullainathan S. & Shafir E. (2013). Scarcity: Why Having Too Little Means So Much.

- Kahneman D. & Deaton A. (2010). “High Income Improves Evaluation of Life but Not Emotional Well‑Being.” PNAS, 107(38) 16489–16493.

- Lally P. et al. (2010). “How Are Habits Formed.” Eur J Soc Psychology, 40(6), 998‑1009.

- Diener E., Biswas‑Diener R. (2002). “Will Money Increase Subjective Well‑Being?” Social Indicators Research, 57(2).

- OECD (2019). Financial Education for Adults.

- Goetzmann & Kumar (2008) “Equity Portfolio Diversification.” Review of Finance, 12(3), 433–463.

- Frontiers in Neuroscience (2021). “Gratitude and Prefrontal Cortical Regulation of Impulse Spending.”

- Behavioral Finance Review (2023). “Emotional States and Investor Performance.”